Renters Insurance in and around Gretna

Looking for renters insurance in Gretna?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Gretna Renters!

No matter what you're considering as you rent a home - utilities, size, price, apartment or townhome - getting the right insurance can be vital in the event of the unexpected.

Looking for renters insurance in Gretna?

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

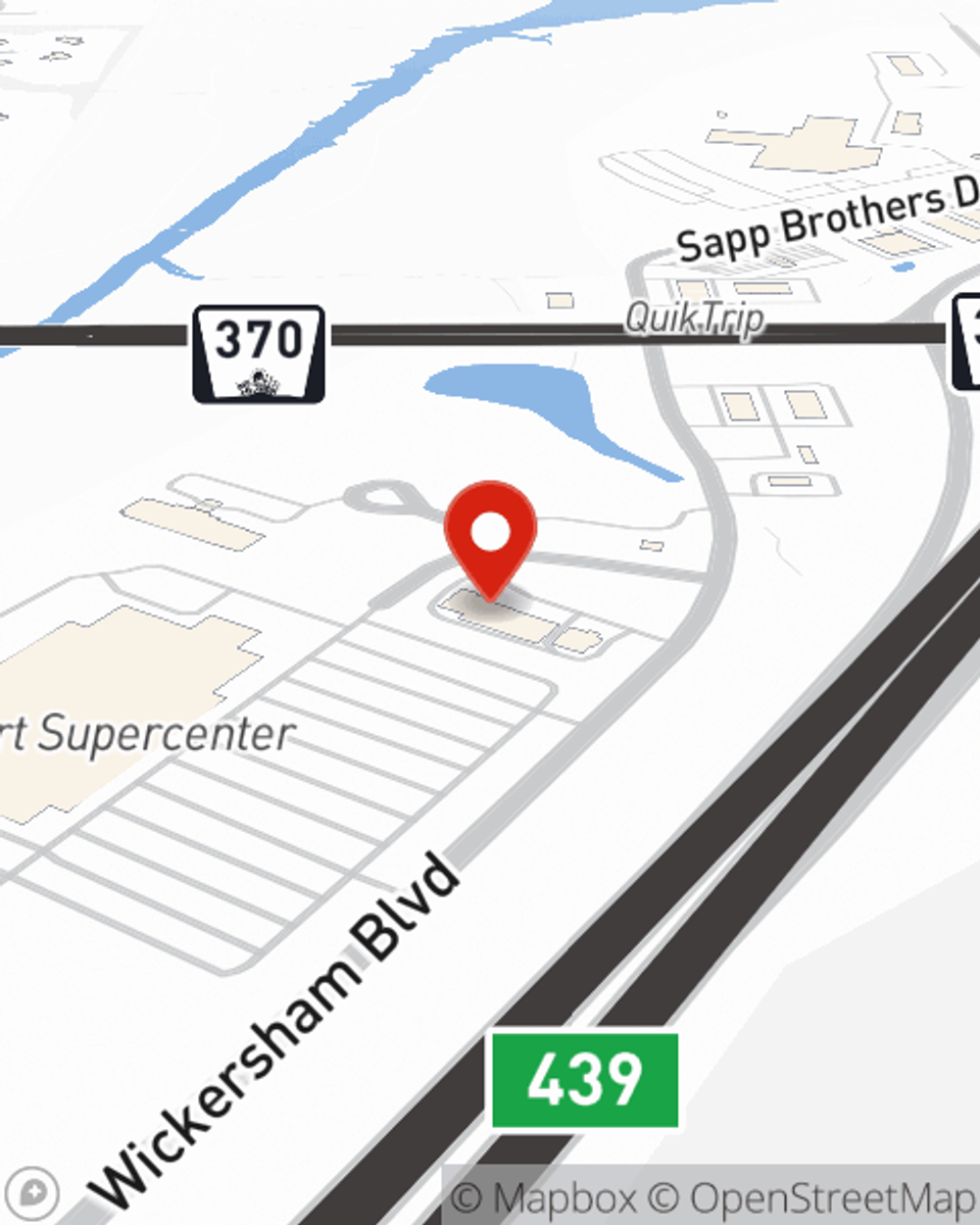

When the unpredicted vandalism happens to your rented townhome or property, often it affects your personal belongings, such as a microwave, a TV or a coffee maker. That's where your renters insurance comes in. State Farm agent Derek Bird has a true desire to help you examine your needs so that you can insure your precious valuables.

It's always a good idea to be prepared. Reach out to State Farm agent Derek Bird for help learning more about options for your policy for your rented unit.

Have More Questions About Renters Insurance?

Call Derek at (402) 891-8926 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.